The Fed and the BOJ More Fed cuts to come....but not the sort that will contiue to inspire confidence in equity markets. In Japan the battle for central bnk independence will be declared when Ueda raises rate by 75BP in the BoJ December meeting. That will ... Read More

News LibraryShowing All Results

Odd bins

This Oddbins Some vital investment themes: Shipping - reinforced optimism. Trump "deal" with Xi changes nothing. And other shipping sector events reconfirm the need for massive shipbuilding and port investment in the US and for the US. US Supreme Court - almost all decisio... Read More

Peter Lewis Money talk with David Roche and Fancis Lun discussing: China the green ambitions and why the EU is the over-achieving dark horse; Trump change of tone on Ukraine- blather ot substance; The Fed loss of independence. h

Peter Lewis Money talk with David Roche and Fancis Lun discussing: : China the green ambitions and why the EU is the over-achieving dark horse; Trump change of tone on Ukraine- blather or substance; The Fed loss of independence. Read More

Odd bins

Odd bins Investment Conclusion Asian equities added as European equities reduced. A warning on Fed Independence. Shipping data show weakness in the US economy. Read More

Odd bins: Jackson Hole, Russia & Shipping

Odd bins: Jackson Hole, Russia & Shipping Investment Conclusion : Jackson Hole is a pivot in the Fed’s reaction function which now under-emphasises tariff effects on inflation and over-emphasises the weakening labor market. So more cuts than I thought (3 at le... Read More

RTHK The Close: Jackson Hole Pivot and President Trump’s Crusade Against the US Fed

RTHK The Close: Carolyn Wright, Richard Harris & David Roche discuss Jackson Hole policy shift and Trump’s plot against the US Fed. Market implications. Read More

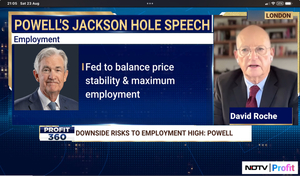

NDTV: David Roche: US Fed Pivot at Jackson Hole: Doubtful Assumptions and False Analysis

NDTV: David Roche: US Fed Pivot at Jackson Hole: Doubtful Assumptions & False Analysis Read More

The Jackson Hole Pivot

The Jackson Hole Pivot Investment Conclusion What Chair Powell's newly announced policy means for investors: More asset bubbles in equities, crypto and non-bank credit; Higher inflation down the road as the money will be printed to fund it; ... Read More

CNBC- Access Middle East: with Dan Murphy and David Roche: What to expect from Jackson Hole & why tariffs are not of temporary effect.

Like it or not, the US Fed's Jackson Hole Conference is going to be all about Fed independence and the battle with President Trump to preserve it. The anodyne (labor market) theme of the Conference will not defuse that bomb. The issue of whether inflation concerns should outwe... Read More