Iran – the Beginning of the End! It may take time. But all roads lead to the same outcome. Some are smooth. Others are bloody. But the Iranian regime is doomed. Compared to Venezuela re-integrating Iran into the comity of civilised nations will be a cinch. Econo... Read More

News LibraryShowing All Results

Tariffying Moment

Tariffying Moment. The US Supreme Court is set to publish, on Friday, January 9, its opinions & and probably its verdict on the use of IEEPA tariffs. N egative for US Treasuries and the US$. No bonanza for EM equities, This report looks at the consequences ... Read More

David Roche on NDTV - The Big Question! Jan 8 Why Trump Wants Greenland: Power,Poltics, Oil and What Else?

David Roche on NDTV - The Big Question! Jan 8 Why Trump Wants Greenland: Power, Poltics, Oil, Minerals and More……but what more? This is discussed and the key issue of whether this is a permanent or a termporaty shift is addressed. Read More

Peter Lewis Money Talk - the meaning of Trump’s new aggressive foreign policy- from countries to tankers & from rare earths to oil, the US is on a grab binge.

Peter Lewis Money Talk - the meaning of Trump’s new aggressive foreign policy- from countries to tankers & from rare earths to oil, the US is on a grab binge with scant reference to law! Read More

Venezuela: Now Comes the Hard Part!

Venezuela: Now Comes the Hard Part! This analysis focuses on the reasons why there is no bonanza in waiting for the US in terms of Venezuelan oil capture. In brief: It's the wrong sort of oil and there is little global demand for it. Costs of getting it out of the gr... Read More

Venezuela: will oil majors rush in ?

Will US Oil Majors rush into Venezuela where others fear to tread? Read More

Iran is unlikely to be a Venezuelan domino but, when the time comes, a domestic economic one.

Iran is unlikely to be a Venezuelan domino but, when the time comes, a domestic economic one. Read More

CNBC Asia - disecting Trimp’s ambitions for Venezuela & the politics of Sheres of Influence with amitoj Singh & David Roche.

CNBC Asia - disecting Trimp’s ambitions for Venezuela & the politics of Sheres of Influence with Amitoj Singh & David Roche. Read More

The Connectors -A Random Walk Through Venezuelan Consequences

The Connectors -A Random Walk Through Venezuelan Consequences The consequences of the fall of Maduro entail: 1. US focus on spheres of influence and global energy and strategic mineral dominance. 2. Geopoltical contagion to states like Cuba & Iran. 3. Mispl... Read More

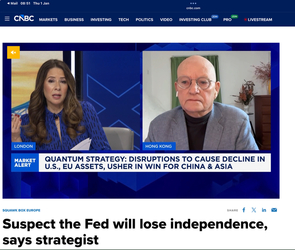

CNBC Squawk Box: why 2026 consensus is crap (with due respect)!

CNBC Squawk box Europe: David Roche Quantum Strategy: why 2026 consensus is crap (with due respect)! Read More