Tariffying Moment. The US Supreme Court is set to publish, on Friday, January 9, its opinions & and probably its verdict on the use of IEEPA tariffs. N egative for US Treasuries and the US$. No bonanza for EM equities, This report looks at the consequences ... Read More

Reports LibraryShowing All Results

Global Shipping: US Titan or Titanic?

Global Shipping - The US: Titan or Titanic Summary Shipping is like dark matter in the Universe. It keeps things expanding smoothly. It runs hypothetically in the background of world affairs like dark matter and energy in the universe. It prevents (stellar or earthly)... Read More

President Trump’s Post Supreme Court Ruling - Tariff Options.

President Trump’s Post Supreme Court Ruling - Tariff Options. Investment Conclusion The Supreme Court (SC) ruling on the Administration’s use of emergency powers to impose tariffs will be binary. If it goes in favour of the Administration expect an upsurge i... Read More

President Trump’s Putin Pivot

President Trump’s Putin Pivot Investment Conclusion Trump’s Pivot on Putin is probably due to a sense of personnel betrayal. This is likely to make it more durable than if it was based on a moral policy vision. The pivot has the potential to change the battlefield in ... Read More

Monday Odd Bins.

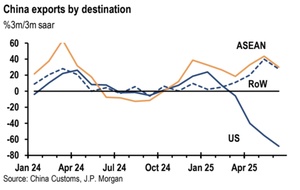

Shipping Data. So far, Chinese total exports have weathered US tariffs without a contraction. Exports to other places than the US have grown and more than offset losses to the US. That is "normal" as US exports are only US 500bn out of a total of nearly US$ 4 trn. The questi... Read More

Trade Update

Trade Update Date: Saturday, July 12, 2025 Investment Conclusion The range and level of tariff threats made by the US this week is not something President Trump can go TACO on. Indeed the accusation that he is TACO on Tariffs probably is a factor behind the current... Read More

Parsing FOMC Minutes and Tariff Announcements

Parsing FOMC Minutes and Tariff Announcements I parsed the FOMC minutes. I think the Fed will hang tough. Seems only Bowman & Waller want to cut. All the others more worried about inflation than the labour market. I expect inflation to rise sharply & durably in... Read More

Interregnum

Interregnum Investment Conclusion This is a short-term interregnum of peace and happiness which will not last long. On May 23 the portfolio sold 10% of safe haven assets (oil & gold) and bought European equities and the Euro. It is probable that President Tru... Read More

Update: US Container traffic and Escalation in the Baltics and Ukraine?

Investment Conclusion President Trump will get more extreme on tariffs. Watch China & the EU. Russia will escalate in Ukraine after a significant hi tech defeat. Neither is bullish for financial assets. If Putin escalates in the Baltic on top of his current escalation t... Read More

Trump Trade Policies in disarray

The US Court of International trade has ruled that the Trump Administration’s trade tariffs, both reciprocal and fentanyl, are illegal. The US Court of International Trade says Trump overstepped his authority - using a 1977 federal economic emergency law. The law does not ... Read More