The BoJ chose to do nothing, On the one hand it is afraid to raise rates and then being surprised in a few months when tariffs create deflationary pressure so it has to reduce rates again. On the other hand, if it doesn't raise rates the yen weakens and imported inflation may s... Read More

Media LibraryShowing All Results

The Micro Podcast on Macro Matters

Quantum Strategy - The Micro Podcast on Macro Matters: What's happened but matters still: China data; Germany - what the Bundesbank believes; Korea - the constitutional crisis; & France - why a decent PM makes no difference - no reform before the populists take over. And to ... Read More

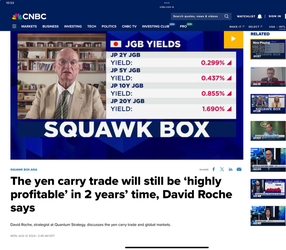

CNBC Squawk Box: Japanese Election Result- Meaning for Markets

Japanese elections mean weak coalition government. Markets will see Yen weaken - Boj stops normalising policy. Weak yen and likelihood of fiscal packages (to buy votes) means stringer equities. JGB tields will rise reflecting bigger deficits. Read More

Money Talk with Peter Lewis: China Policy - assessing the equity market blow off and how sustainable it is

A great discussion of China's market ramp and its sustainability with Peter Lewis and Enzio Pfeil- everything from culture to Hayek Read More

RTHK: The Close- Tech Grayzone Warfare, China Deflation & the US Presidential Election

RTHK - The Close- Tech Grayzone Warfare, China Deflation & the US Presidential Election Read More

The BoJ, The Yen and Global Liquidity

Yen Strength - will Japan suck global liquidity dry? Read More