The Fed acts to reduce the number of interest rate cuts in 2025. Underlying this is that the Fed Funds Rate is already close to the neutral rate and more cuts are not needed given that the economy is motoring and inflation is a bit high. But the knock-on effects on markets arou... Read More

Media LibraryShowing All Results

Mini Podcast on Macro

The Mini Podcast on Macro - that may matter to markets China - false dawn in retail & housing?. What Xi said to Biden to say to Trump: China's 4 Red Lines (actually 3) with one a tautological obsession which tells us what Xi is prioritising. What the official anonymous China... Read More

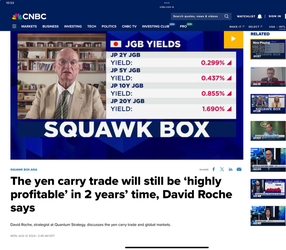

CNBC Squawk Box: Japanese Election Result- Meaning for Markets

Japanese elections mean weak coalition government. Markets will see Yen weaken - Boj stops normalising policy. Weak yen and likelihood of fiscal packages (to buy votes) means stringer equities. JGB tields will rise reflecting bigger deficits. Read More

RTHK: The Close- Tech Grayzone Warfare, China Deflation & the US Presidential Election

RTHK - The Close- Tech Grayzone Warfare, China Deflation & the US Presidential Election Read More

Money Talks

Can Kamala Harris plug the vicissitudes of her economic policy pronouncements? Read More

The BoJ, The Yen and Global Liquidity

Yen Strength - will Japan suck global liquidity dry? Read More