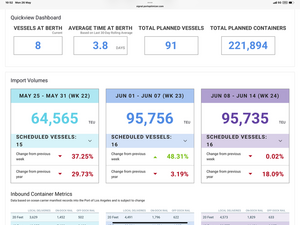

The Port of Los Angeles Data as of May 26 for the period to June 14 shows some recovery of inbound container verssels to +/- 100,000 TEU per week. This level remains well below the same period in the previous year. Evidence of a surge in shipments from China is absent. Read More

Reports LibraryShowing All Results

Wealth Preservation Portfolio (WPP) - Update

Wealth Protction Portfolio - Update Investment Conclusion There is no change in my pessimistic view of the current rally in risk assets. The only change in the WPP this week is to add some risk diversification in the form of Hong Kong equities (the Tracker) – see: ... Read More

Doing an Odd Thing – Hong Kong

Doing an Odd Thing – Hong Kong Investment Conclusion I am buying some HK equities. HK assets are a diversification of US policy risks. The worse it goes for the US, the more money pours back into HK. The HK$ peg does the rest. The inflows surge domestic liquidity. ... Read More

US Treasury International Capital Data for March - Too early to say!

Short US$ is a core position in the Wealth Preservation Portfolio. Investment flows in and out of the US$ need to be monitored. The TICS data for the month of March do not provide any indication of substantial outflows happening. But that could only be expected after April ... Read More

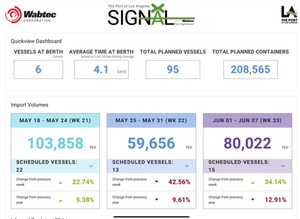

Port of Los Angeles Container Data Bookings May 18 to June 7

The Port of LA accounts for 40% of all ship board container traffic into the US. About 50% of its inward shipments are from China. So its a good indicator. The port is showing year on year falls in total inward container shipments between May 25 and June 07 of between 1... Read More

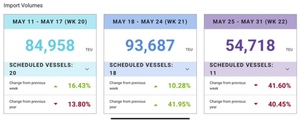

Update: US Import Surge? Port of Los Angeles Update May 15, 2025 - No surge yet!

Port of Los Angeles in-bound container traffic forecast for next three weeks. The forward booking for container traffic (in TEU) until May 31 does not yet show a surge in US imports. The data through May 31 (week 22) are shown in the graphic updated on May 15, 202... Read More

The Phoney Peace?

The Phoney Peace? Investment Conclusion The market reaction to reduced US-China tariffs is unwarranted. The S&P 500 has clawed back all of its post Liberation Day losses and is only 5% below its peak. The existing tariffs and uncertainty will do a lot more... Read More

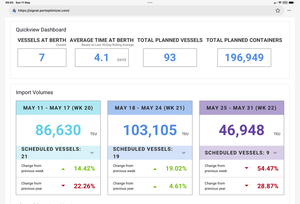

Port of los angeles data for next three weeks. Issued on 05.11.2025

Port of los Angeles data for next three weeks: inward Container Ship Traffic. Issued on 05.11.2025 The big recovery in weeks out has gone. We are looking at a 20% to 25% decline in container ship arrivals. That equates to a “stop” of Chinese inward container traffic to LA... Read More

The Wealth Preservation Portfolio

Wealth Preservation Portfolio - Weekly Update - 05.07.2025 The markets are priced for a normalisation of global trade. I do not believe this will happen. The conversation between China and the US will not lead us back to normal trade. Tariffs will settle at 20% on average... Read More

Taiwan & HK: Butterfly Wings & Chaos?

Taiwan & HK: Butterfly Wings & Chaos? Investment Conclusion. The Taiwanese dollar (TWD) and the Hong Kong dollar (HKD) are under upward pressure. There are idiosyncratic reasons for this delved into below. But the real culprit is the fall of confidence in the... Read More

March 2025_Thumbnail.jpeg)