Monday Oddbins Investment Conclusion Two things stand out from the data. The first is just how bad the EU-US trade agreement is. The second is the significant weakening of Port of Los Angeles three- week forward-looking anticipated container inflow. Read More

Reports LibraryShowing All Results

EU-US Tariff Deal: Ursula Sings from the President’s Hymn sheet

EU-US Tariff Deal: Ursula Sings from the President’s Hymn sheet Investment Conclusion: Equity Markets will like the deal. It removes trade war uncertainty. But more for equities than any other asset class, the uncertainty about the hit to profits and discount factors... Read More

Shifting Sands - error corrected

the Shifting sands report had a mistake. The text said US tariffs on Japanese steel and aluminium was 25% it is of course 50%. the figure of 50% was throughout the report - including grahics and tables. sorry! d Read More

Tariffs: How Good is Bad? The US-Japanese hadshake deal

Tariffs: How Good is Bad? The US-Japanese hadshake deal Investment Conclusion The equity markets are rejoicing at the latest US tariff deals. I am not. And neither are bond markets or the US $. The Japanese handshake 15% tariff deal is better than the mooted 25% tariffs. Bu... Read More

Shifting Sands

Shifting Sands Investment Conclusion The result of the Japanese election heralds a period of weak government at a critical time. That undermines the safe haven status of the Yen. The Yen long position in the Wealth Preservation Portfolio is being sold. A short... Read More

The Stable Coin Plot?

Executive Summary: The Stable Coin Plot? Stablecoins are the privatisation of money. They have the potential to: • Disrupt traditional banking systems. They can suck deposits out of the banking system leaving significant funding gaps for banks and the “real” economy. ... Read More

President Trump’s Putin Pivot

President Trump’s Putin Pivot Investment Conclusion Trump’s Pivot on Putin is probably due to a sense of personnel betrayal. This is likely to make it more durable than if it was based on a moral policy vision. The pivot has the potential to change the battlefield in ... Read More

Monday Odd Bins.

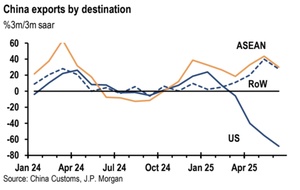

Shipping Data. So far, Chinese total exports have weathered US tariffs without a contraction. Exports to other places than the US have grown and more than offset losses to the US. That is "normal" as US exports are only US 500bn out of a total of nearly US$ 4 trn. The questi... Read More

Trade Update

Trade Update Date: Saturday, July 12, 2025 Investment Conclusion The range and level of tariff threats made by the US this week is not something President Trump can go TACO on. Indeed the accusation that he is TACO on Tariffs probably is a factor behind the current... Read More

Parsing FOMC Minutes and Tariff Announcements

Parsing FOMC Minutes and Tariff Announcements I parsed the FOMC minutes. I think the Fed will hang tough. Seems only Bowman & Waller want to cut. All the others more worried about inflation than the labour market. I expect inflation to rise sharply & durably in... Read More