Things of Note: Shipping The shipping data is interesting. US container imports for May were down 7% through all ports. US shipping exports (including non container traffic) were similarly weak. The Port of LA data continues to show a bid drop in container imports 3 wee... Read More

Reports LibraryShowing All Results

Things of Note

Things of Note: I nvestment Conclusion The shipping data points to weakening US import demand and GDP. China appears to be replacing lost exports to the US with those to other Asian countries. Trump’s tariff letters are likely to be taken as more Guff to be followed by T... Read More

Interregnum

Interregnum Investment Conclusion This is a short-term interregnum of peace and happiness which will not last long. On May 23 the portfolio sold 10% of safe haven assets (oil & gold) and bought European equities and the Euro. It is probable that President Tru... Read More

Port of Los Angeles Inward Bound Container Data

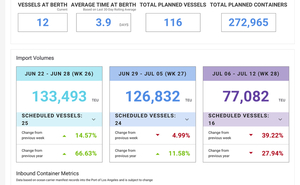

The Port of Los Angeles Inward Bound Container Data continue to show 137k and 115k TEU arrivals per week in eacjh of the next two weeks and a big drop thereafter. Much of that drop may be ironed out as we get closer to the the week (29) of July 13 to 19. That's what happened t... Read More

President Trump – Love Him or Hate Him – Don’t Underestimate Him !

President Trump – Love Him or Hate Him – Don’t Underestimate Him! Investment Conclusion: When a big ship goes full circle in a stormy sea, it creates what is known as a 'Duck Pool' of calm water (once use to land naval sea planes). That lasts a while before the big... Read More

Middle East Trump Declares Total All Part Ceasefire

Trump: Donald J. Trump @realDonald Trump CONGRATULATIONS TO EVERYONE! It has been fully agreed by and between Israel and Iran that there will be a Complete and Total CEASEFIRE (in approximately 6 hours from now, when Israel and Iran have wound down and completed their ... Read More

ME- First the Bang. Date: Monday, June 23, 2025 Now the Whimper!

ME- First the Bang. Now the Whimper! Investment Conclusion The time of maximum risk is over. The Mullahs will shift to survival mode. They will not seek to escalate militarily – though a few revenge suicide bombings could happen. Any significant escalation by Iran ... Read More

US Container Traffic, TICS, The BIS Study of the weaker US$ & BBB Clause 988

This Update will be quick as the Middle East is dominating research resources! 1. Port of Los Angeles Data shows fairly stable container flows at TEU 134k and then 127k for next two weeks but then there is a pretty massive fall to TEU 77k in the week of July 6 to July 12. If... Read More

ME – No Taco but Attack

ME – No Taco but Attack Investment Conclusion. President Trump has not gone TACO on Iran. The US will attack Iran’s nuclear asserts (e.g. Fordow) if Iran does not totally surrender its nuclear assets in short shift. No more negotiations. No more ducking and weaving. No... Read More

ME- Portfolio on War Footing

ME- Portfolio on War Footing Investment Conclusion President Trump has shifted his stance to demanding “unconditional surrender” of Iran. If this is not just rhetoric or a negotiating ploy, it opens the way to escalation of the war. Israel and the US would then ... Read More