Live with CNBC from the Housing Ministry's presser commenting on the latest measure to solve the housing problem. Won't work. Does not address housing demand. Read More

News LibraryShowing All Results

China - The Heart of the Blather

China- why the stimulus packages won't work and what it means. China remains uninvestable Read More

RTHK The Close

RTHK - The Close: China fiscal stimulus- good money after bad?. The US Presidential Election - political & market outcome. . The Middle East - which war now? Read More

The Mini Podcast on Macro

The Mini Podcast on Macro that may matter to markets - US Presidential, China Stimulus, Israel & Iranian assets - the "Big If". Read More

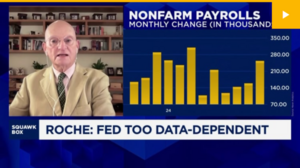

CNBC Squawk Box- Fed Jumbo cuts - the hidden damage

The Silliness of the Fed's JUMBO cut and the hidden damage. Watch on CNBC. Read More

RTHK Global Issues with Carolyn Wright

Global Issues with Carolynn Wright on RTHK "The Close": US jobs, China Stimulus, the Middle East War and Ishiba's Japan! Read More

Winter of Discontent

There will be a bear market in the next 12 months. The DNA of the bear market is writ large: the inevitable war on Iran’s nuclear weapons capabilities; Russia and Ukraine again becoming economically relevant to markets; unrequited market expectations for growt... Read More

The Mini Podcast on Macro Matters

The US Swing State Polls & the Crafting of the Israeli Retaliatory Attack on Iran. Read More

Middle East: The Inevitable War That'll Matter to Markets

A war on Iran's nuclear assets is inevitable within a year. That is the geopolitical event that will produce a market meltdown because any attack on nuclear weapons facilities raises the risk of the terminal value of your assets being zero, Read More

Middle East- The Mullah’s Mad Gamble

I got the Iranian attack on Israel wrong. All now depends on Israel's targeting of its escalatory response. If Israel uses its intelligence to decapitate the Iranian regime (and the IRGC), as it did with Hezbollah, then the economic spillover effects (e.g. energy)) will be limit... Read More